How to Read Your Paycheck

Last updated September 3, 2025

Have a new job? We share how to read your paycheck!

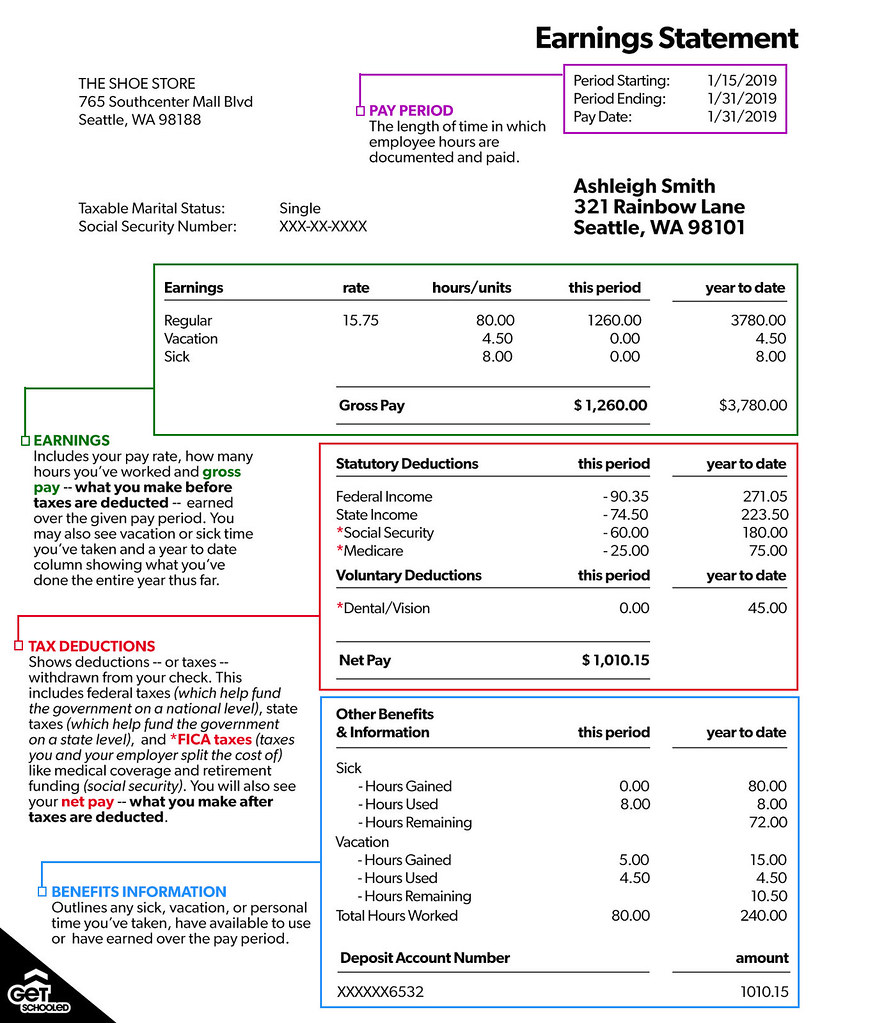

Most paychecks have two parts: your pay stub and paycheck. Your paycheck provides what is referred to as net pay, or the money that is available for you to spend. Your pay stub outlines your gross pay, or the money you made before taxes, and any other deductions withdrawn from the check you received.

It's important to note that every pay stub will look different depending on the employer. If you have questions about yours, be sure to reach out to your HR or accounting department.

Key Terms to Know Before You Read Your Pay Stub

- Gross Pay: The total amount of money you earned before any taxes or deductions are taken out.

- Net Pay: The amount of money you take home after taxes and deductions, this is your actual paycheck.

- Tax Deductions: Money taken out of your paycheck for federal, state, and sometimes local taxes.

- Other Deductions: These can include things like health insurance premiums, retirement contributions, or union dues.

- Year-to-Date (YTD): This shows the total amount you’ve earned and the total deductions taken out from the beginning of the year up to the current pay period.

- Pay Period: The time span for which you’re being paid (e.g., two weeks, one month).

Here’s an outline of a typical pay stub and what you can expect to find on it:

Do you have any more questions about reading your paycheck? Connect with a Get Schooled Advisor.