Checking & Savings Accounts: What's the Difference?

Last updated June 5, 2024

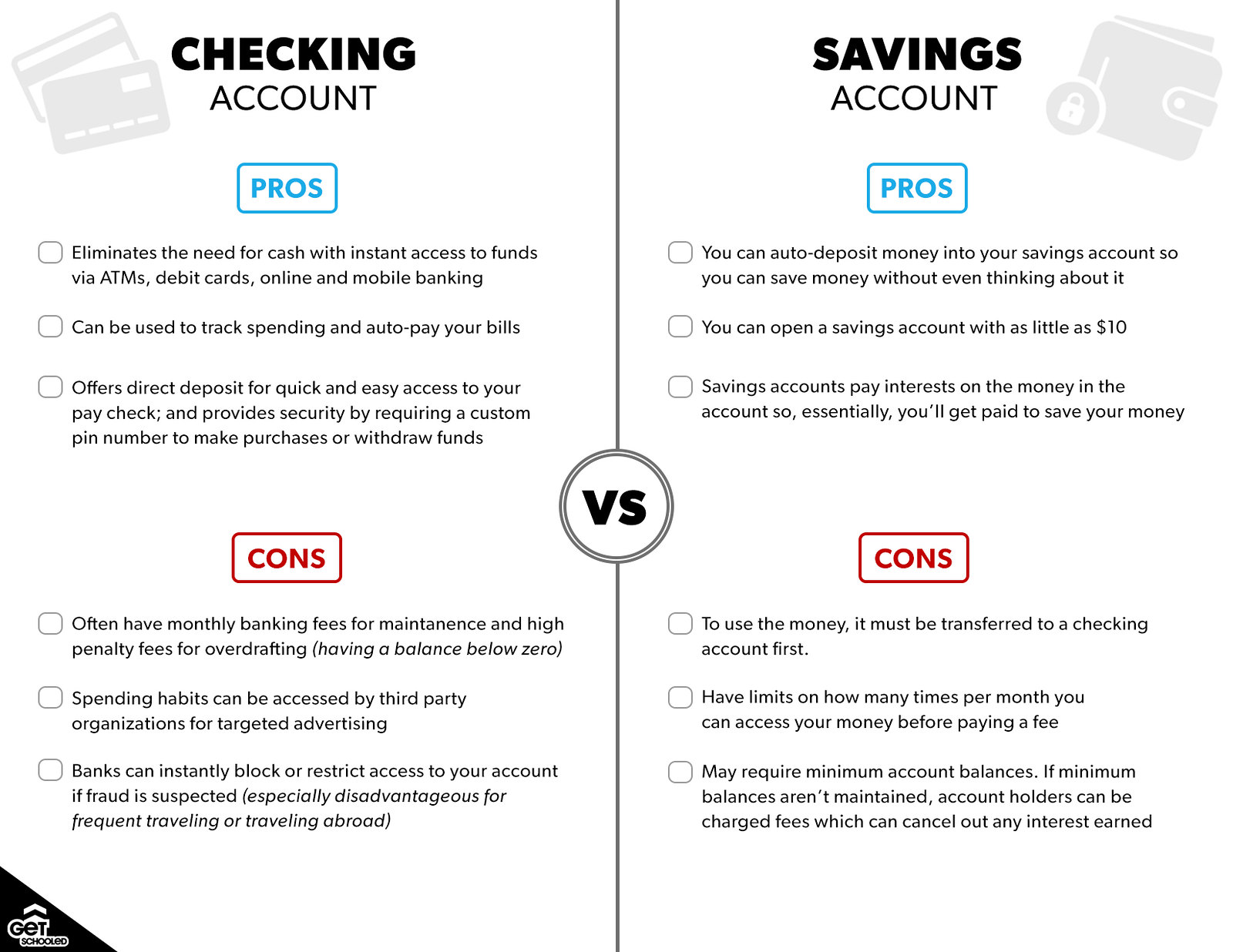

There are two main types of bank accounts: checking and savings. We break down differences between the two and highlight why they're important!

Note: Before making any big financial decisions, we strongly advise you to talk to a parent/guardian or a trusted adult. They can help you make informed choices about building credit and taking on debt that can ensure your financial stability and success in the future.

What is a checking account?

A checking account is a bank account for everyday expenses. You can use it to have paychecks deposited, make purchases, withdraw cash, and pay bills. It’s a convenient way to quickly access your money, anytime, anywhere. Requirements for opening a checking account will vary based on the bank you choose, but keep in mind there are fees associated with a checking account, like overdraw fees, if you don’t monitor it.

What is a savings account?

Money that you want to set aside for things like vacations, large purchases, or unplanned emergencies should go in a savings account. Unlike checking accounts, many savings accounts earn interest, meaning you earn a bit of additional free money each month just by keeping money in your account!

Take a screenshot or save the image below to reference when opening up a bank account!

For more money management tips, be sure to check out the rest of our free money management resources to learn how to be a smart spender and saver! And if you have any job or finance-related questions for us, just text #Jobs to 33-55-77 to chat with one of our advisors (if you're on a mobile device click here to have the text message set up for you)!